Who We Serve

Serving 25,000 Customers Across Our Northeast Footprint

Resellers

With nearly 150 years in the energy business. and local account managers in the field, we're proven in the industry. We actively expand our product offering and terminal network based on specific customer demand, and deliver the kind of personalized service and market intelligence you can't find anywhere else. we strive every day to help your business succeed.

Online Buying

Learn more about the online Sprague Real-time® pricing tool - the industry's best and simplest online pricing tool.

Learn MoreGovernment

Sprague has the knowledge, expertise and track record to meet the energy needs of federal, state and local government. From major transit authorities, to hundreds of public schools and government buildings, we deliver the energy that keeps our country’s infrastructure running. We tailor our offerings to your unique requirements — from specialized natural gas programs to retail fueling and bulk fuel deliveries.

Sprague provides energy continuity through electronic tank monitoring and precise overnight fuel replenishment, and our extensive network of strategically located terminals and pipelines throughout the Northeast help ensure supply during both normal times and periods of disruption. Order history and detailed invoices are available online, streamlining administrative logistics for busy government offices.

Learn MoreManufacturing/ Industrial

Meeting the complex energy needs of industrial and manufacturing customers is at the core of our expertise, and we know downtime is not an option. That’s why Sprague creates dependable programs tailored to your energy requirements—whether you work with heavy oils, or a combination of petroleum, power and natural gas. Our dual fuel services team offers customized programs to help you financially benefit from short or longer term price spikes in the market. Your local Sprague Account Manager consults with you using high quality, real-time energy market data to help develop custom strategies that meet your energy needs, budget objectives, and risk tolerances. Our depth of knowledge and breadth of pricing programs make us a premier energy delivery partner.

Learn MoreCommercial

Sprague serves a wide range of commercial accounts, providing products, tools and market intelligence to help you control costs and manage complex energy needs. Sprague’s local account managers draw from a diverse selection of products to deliver tailored energy solutions, while providing exceptional customer service, precise attention to detail, and the actionable insights you need to manage your energy costs. We work diligently so your business can run at its best.

Learn MoreBrokers/ Agents

Sprague embraces the ability to proactively support third-party representatives in the field with market insights, pricing tools, sales collateral and training. Our partners are an important extension of our company. We offer brokers and channel partners the ease of one-stop electronic access to all the same information and management tools provided to customers through SpraguePORT®. We are also happy to create tailored reports, provide real-time energy data and offer our dedicated pricing desk — all to help you succeed.

Learn MoreEnergy Field Services

We provide 24/7 support to drilling and field services in the natural gas industry, from our range of fuels to our wide selection of storage products. Sprague's high quality products and unbeatable fuel services separate us from our competitors. Whether you're looking for drilling or frac fuel services, Sprague is ready to help you succeed by keeping your site fueled.

Learn MoreFueling Possibilities for Over 150 Years

Founded in 1870 as a distributor of coal and petroleum-based products, today Sprague is one of the largest independent suppliers of energy products and related services in the Northeast. Our strategically located refined products and materials handling terminals, coupled with our

natural gas pipeline capacity, give us unique access to energy products and services. We market products to over 25,000 commercial, industrial, utility and wholesale customers.

Explore Our Service Areas

Service Offerings

The Energy Partner You Need to Prosper in Tomorrow’s Markets

Wholesale Fuel

Sprague delivers hundreds of millions of gallons annually from our strategic terminals, offering top-tier service, market insights, hedging plans, and an advanced online tool for you and your customers.

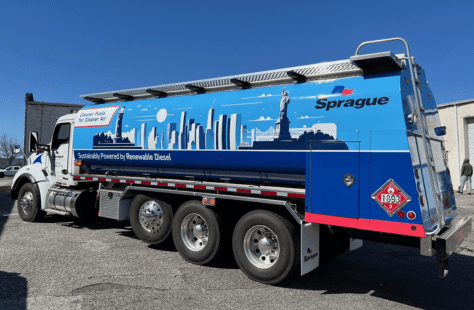

Delivered Fuel

Sprague ensures an uninterrupted fuel supply to keep your business running smoothly. Count on us to maintain warmth and efficiency in your buildings, ensuring optimal performance for your business.

Natural Gas

As a natural gas supplier, we customize solutions for your business needs using market insights, historical analysis, and economic trends. Our experts create cost-efficient energy plans tailored for you.

Materials Handling

With strategic Northeast terminals, we handle onshore and offshore needs seamlessly. From unloading asphalt to transporting wind turbine blades, count on us for efficient and safe solutions.

Electricity

Sprague's electricity procurement protects you from market fluctuations, letting you streamline energy procurement and drive business success.

Solar

Sprague installed solar panels on our storage tanks and extend this solution to terminal operators nationwide.

Sprague at a Glance

150+

Years

Transitioning Energy Sources

21

Terminals

Across the Northeast & Quebec

20+

Years

Handling On-Shore Wind Components

28

Million

Gallons of Low-Carbon Fuel

Stay Up to Date

Our Latest Insights and Market News